Put Your Tax Refund To Work – EDWARD JONES

Written by hpl on February 2nd, 2025

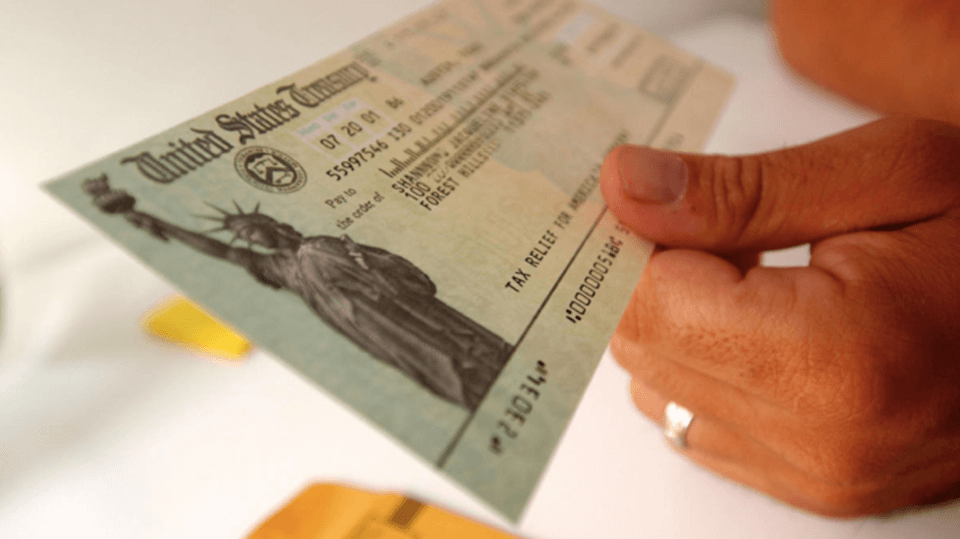

It’s that time of year when tax refunds are going out. If you get a refund this year, how can you make the best use of it?

The answer depends somewhat on the size of your refund. Last year, the average refund was $3,050, according to the Internal Revenue Service.

But regardless of how big your refund is, look for the ways it can help your financial situation.

For starters, you could use your refund to help fund your IRA. You still have until April 15, 2025, to contribute to your IRA for the 2024 tax year, but if you’ve already put in the full amount, you can start on 2025 contributions.

If you have children or grandchildren, you could use some of your refund to help fund a tax-advantaged 529 education savings plan.

Another possibility is to use the refund to pay down some of your debts. You could try to pay off the smallest debts as soon as possible or, alternatively, tackle the debts that carry the highest interest rates.

It’s not often that you receive a financial windfall like a tax refund — so think carefully about how you can maximize its benefits.

This content was provided by Edward Jones for use by your local Edward Jones Financial Advisor, Casey Caliva, at Historical 30th & Fern.

Member SIPC

Address: 2222 Fern St., San Diego CA 92104Phone: 619-516-2744Web: www.edwardjones.com/casey-caliva