Should You Be a Global Investor? – EDWARD JONES

Written by hpl on August 22nd, 2024

Investment opportunities don’t stop at the U.S. border. But what should you know about investing internationally?

When you invest outside the United States, you can gain at least two key benefits.

First, international investments can help diversify a portfolio that might be heavily weighted toward U.S. stocks. In any given year, the U.S. financial markets may be down while those from other regions of the world could be up. As a result, diversifying through global investments can help reduce the impact of market volatility on your holdings. Be aware, though, that diversification can’t guarantee profits or prevent all losses.

Second, when you invest internationally, you can take part in emerging markets that may offer significant growth potential, fueled by rising consumer spending and rapid advances in technology.

International investing does carry some special considerations, including currency risk, political risk and liquidity risk. And because it’s more challenging to understand the global investment picture, you may want to work with a financial professional.

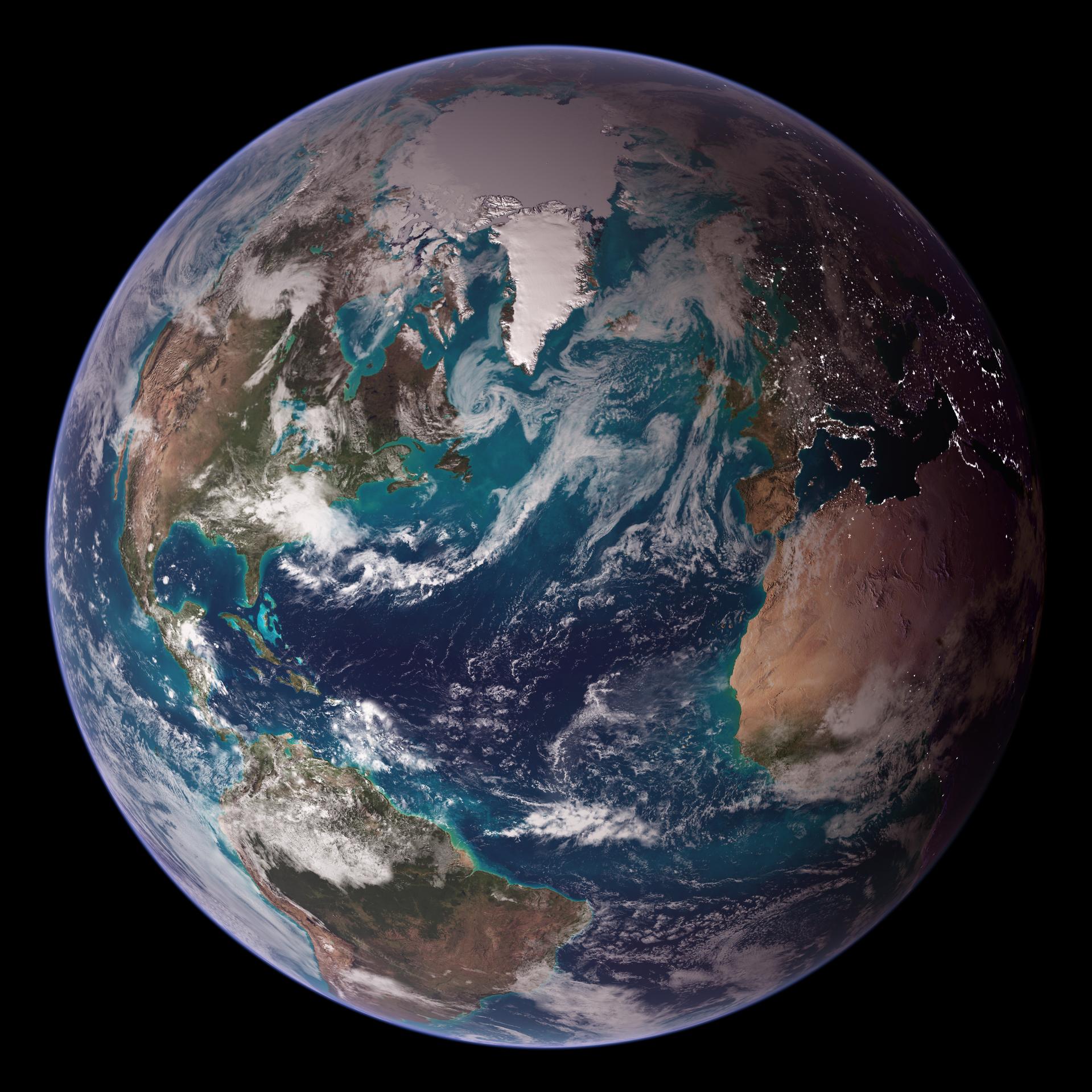

Still, it’s a big world out there — and as an investor, you may want to explore it.

This content was provided by Edward Jones for use by your local Edward Jones Financial Advisor, Casey Caliva, at Historical 30th & Fern.

Member SIPC

Address: 2222 Fern St., San Diego CA 92104Phone: 619-516-2744Web: www.edwardjones.com/casey-caliva